NOTE: This post contains affiliate links for LinkedIn Learning, and I will be compensated if you make a purchase after clicking on my links.

When you start analyzing data from a certain business process, like payroll, it is very helpful to understand the terminology and business rules behind the data.

If you are tasked with dealing with US payroll data, I strongly recommend this short online course about payroll on LinkedIn Learning called, “Human Resources: Payroll”.

This online course about payroll covers topics that relate to tasks you might need to do as a data scientist with payroll data.

Here are some examples:

Implementing program onboarding business rules

Chapter 1 of the online course about payroll talks about common problems encountered in payroll. A big problem in payroll is classifying employees incorrectly according to laws and regulations. Preventing this with business rules built into HR applications could help – as long as you understand the business rules, and they are documented at the organization.

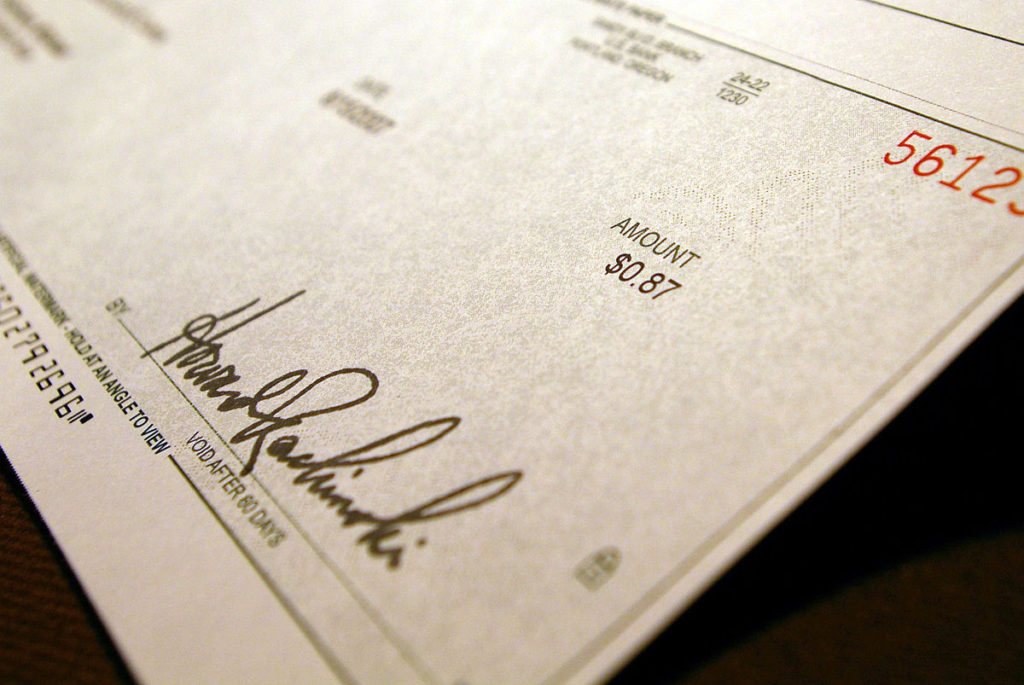

Setting up or adjusting pay cycles with taxes, bonuses, commissions, garnishments, and other deductions

Understanding this terminology and these business rules are especially important if something goes wrong with payroll at your organization, and you need to fix it. This online course about payroll points out that in the US, there are state and federal laws and regulations that need to be followed, and you often end up getting advice from lawyers. Taxes in the US are complicated, but the data scientist will be relied upon to operationalize them in data systems. Because of this, it is necessary for the data scientist to take courses like these to understand what is going on.

Helping reclass independent contractors as employees, and exempt as non-exempt

This online course about payroll points out that with the current “gig economy,” the US has had an epidemic of workers being erroneously classified as independent contractors when they should be classed as employees. If this happens, the data scientist might be called upon to try to create a salary estimate for these former contractors by using their contracting data. The course highlights that the US also has a problem with employees being erroneously classified as being “exempt” from receiving overtime pay. If the data scientist is called upon to address this, it might mean back-calculating overtime pay, so it is important to understand how to arrive at these estimates.

Helping organization transition from manual to automated payroll system

Chapter 2 in this online course about payroll talks about the actual payroll systems. If you are analyzing data, it is probably coming from one of the big systems – but if you are working at a startup, you might be involved in transitioning your organization from manual payroll to some sort of system.

One advantage of doing this task is you will really get to know the data in payroll and the new system, as well as the business rules around payroll at your company!

Building record retention into systems

The online course about payroll goes into laws about record retention – both paper and electronic. Data scientists who program these systems are often involved in setting up ways to automatically place records on a “destroy list” when it is time for them to be destroyed. Since these processes are governed by a patchwork of laws and policies, the data scientist will need to really understand these in order to be successful at readying a system for record retention.

Analyzing leave, benefit, and pay adjustments

Chapter 3 covers these topics. Being able to understand this payroll information can relate to what I call a “carrot or stick” analysis, with carrot meaning “trying to improve and get ahead” and stick meaning “trying to get out of trouble”.

A “carrot analysis” would be trying to understand how leave, benefits, and pay adjustments are being applied in order to improve the system, like reduce absenteeism through improved management approaches.

A “stick analysis” example would be trying to respond to an audit regarding regulatory compliance.

Data Science Tip:

When analyzing payroll data, an employee handbook probably is the most important curation file you can have.

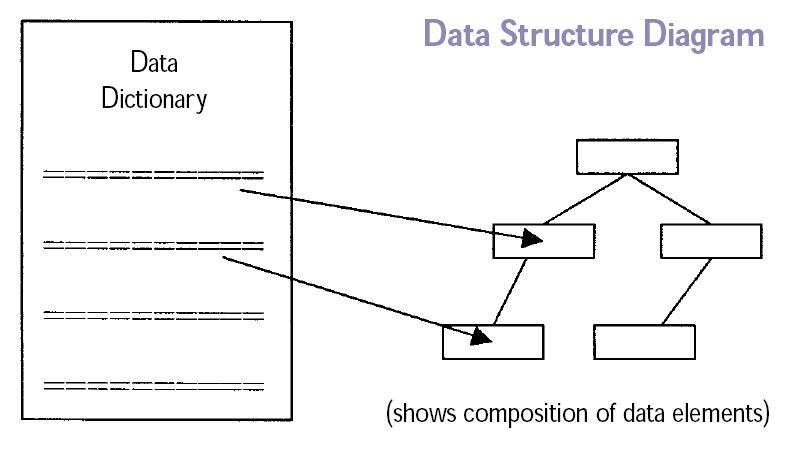

Published November 2, 2020. Picture of royalty check by Michael Kooiman, available here. Picture of federal regulations books by MassDEP, available here. Picture of data entry clerk available here. Picture of archival files by Smallison, available here. Data dictionary diagram from US department of Transportation, available here.

If you receive payroll in the US, you can see that the data on the payroll stub is pretty complicated. This course in payroll is helpful for data scientists who find themselves analyzing US payroll data, because it explains the business rules and regulations behind the data.

Good write-up, I抦 regular visitor of one抯 website, maintain up the nice operate, and It’s going to be a regular visitor for a long time.

Thank you! Glad it was helpful!